Page 380 - 2020-21 Budget Summary

P. 380

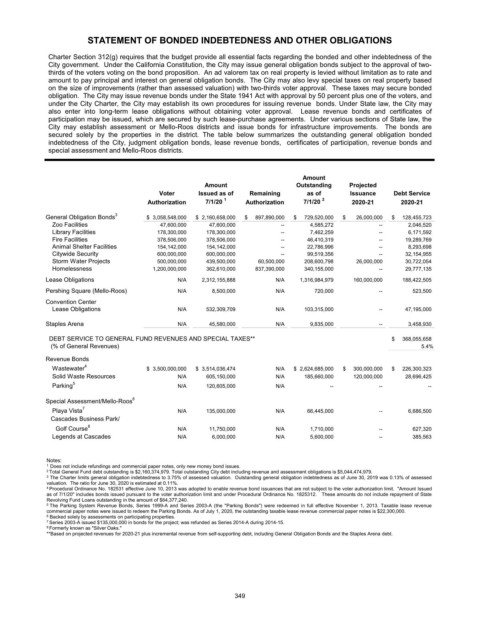

STATEMENT OF BONDED INDEBTEDNESS AND OTHER OBLIGATIONS

Charter Section 312(g) requires that the budget provide all essential facts regarding the bonded and other indebtedness of the

City government. Under the California Constitution, the City may issue general obligation bonds subject to the approval of two-

thirds of the voters voting on the bond proposition. An ad valorem tax on real property is levied without limitation as to rate and

amount to pay principal and interest on general obligation bonds. The City may also levy special taxes on real property based

on the size of improvements (rather than assessed valuation) with two-thirds voter approval. These taxes may secure bonded

obligation. The City may issue revenue bonds under the State 1941 Act with approval by 50 percent plus one of the voters, and

under the City Charter, the City may establish its own procedures for issuing revenue bonds. Under State law, the City may

also enter into long-term lease obligations without obtaining voter approval. Lease revenue bonds and certificates of

participation may be issued, which are secured by such lease-purchase agreements. Under various sections of State law, the

City may establish assessment or Mello-Roos districts and issue bonds for infrastructure improvements. The bonds are

secured solely by the properties in the district. The table below summarizes the outstanding general obligation bonded

indebtedness of the City, judgment obligation bonds, lease revenue bonds, certificates of participation, revenue bonds and

special assessment and Mello-Roos districts. .

Amount

Amount Outstanding Projected

Voter Issued as of Remaining as of Issuance Debt Service

Authorization 7/1/20 1 Authorization 7/1/20 2 2020-21 2020-21

General Obligation Bonds 3 $ 3,058,548,000 $ 2,160,658,000 $ 897,890,000 $ 729,520,000 $ 26,000,000 $ 128,455,723

Zoo Facilities 47,600,000 47,600,000 -- 4,585,272 -- 2,046,520

Library Facilities 178,300,000 178,300,000 -- 7,462,259 -- 6,171,592

Fire Facilities 378,506,000 378,506,000 -- 46,410,319 -- 19,289,769

Animal Shelter Facilities 154,142,000 154,142,000 -- 22,786,996 -- 8,293,698

Citywide Security 600,000,000 600,000,000 -- 99,519,356 -- 32,154,955

Storm Water Projects 500,000,000 439,500,000 60,500,000 208,600,798 26,000,000 30,722,054

Homelessness 1,200,000,000 362,610,000 837,390,000 340,155,000 -- 29,777,135

Lease Obligations N/A 2,312,155,888 N/A 1,316,984,979 160,000,000 188,422,505

Pershing Square (Mello-Roos) N/A 8,500,000 N/A 720,000 -- 523,500

Convention Center

Lease Obligations N/A 532,309,709 N/A 103,315,000 -- 47,195,000

Staples Arena N/A 45,580,000 N/A 9,835,000 -- 3,458,930

DEBT SERVICE TO GENERAL FUND REVENUES AND SPECIAL TAXES** $ 368,055,658

(% of General Revenues) 5.4%

Revenue Bonds

Wastewater 4 $ 3,500,000,000 $ 3,514,036,474 N/A $ 2,624,685,000 $ 300,000,000 $ 226,300,323

Solid Waste Resources N/A 605,150,000 N/A 185,660,000 120,000,000 28,696,425

Parking 5 N/A 120,605,000 N/A -- -- --

Special Assessment/Mello-Roos 6

Playa Vista 7 N/A 135,000,000 N/A 66,445,000 -- 6,686,500

Cascades Business Park/

Golf Course 8 N/A 11,750,000 N/A 1,710,000 -- 627,320

Legends at Cascades N/A 6,000,000 N/A 5,600,000 -- 385,563

Notes:

1 Does not include refundings and commercial paper notes, only new money bond issues.

2 Total General Fund debt outstanding is $2,160,374,979. Total outstanding City debt including revenue and assessment obligations is $5,044,474,979.

3 The Charter limits general obligation indebtedness to 3.75% of assessed valuation. Outstanding general obligation indebtedness as of June 30, 2019 was 0.13% of assessed

valuation. The ratio for June 30, 2020 is estimated at 0.11%.

4 Procedural Ordinance No. 182531 effective June 10, 2013 was adopted to enable revenue bond issuances that are not subject to the voter authorization limit. "Amount Issued

as of 7/1/20" includes bonds issued pursuant to the voter authorization limit and under Procedural Ordinance No. 1825312. These amounts do not include repayment of State

Revolving Fund Loans outstanding in the amount of $64,377,240.

5 The Parking System Revenue Bonds, Series 1999-A and Series 2003-A (the "Parking Bonds") were redeemed in full effective November 1, 2013. Taxable lease revenue

commercial paper notes were issued to redeem the Parking Bonds. As of July 1, 2020, the outstanding taxable lease revenue commercial paper notes is $22,300,000.

6 Backed solely by assessments on participating properties.

7 Series 2003-A issued $135,000,000 in bonds for the project; was refunded as Series 2014-A during 2014-15.

8 Formerly known as "Silver Oaks."

**Based on projected revenues for 2020-21 plus incremental revenue from self-supporting debt, including General Obligation Bonds and the Staples Arena debt.

349