Page 306 - FY 2021-22 Blue Book Volume 2

P. 306

Capital Finance Administration Fund

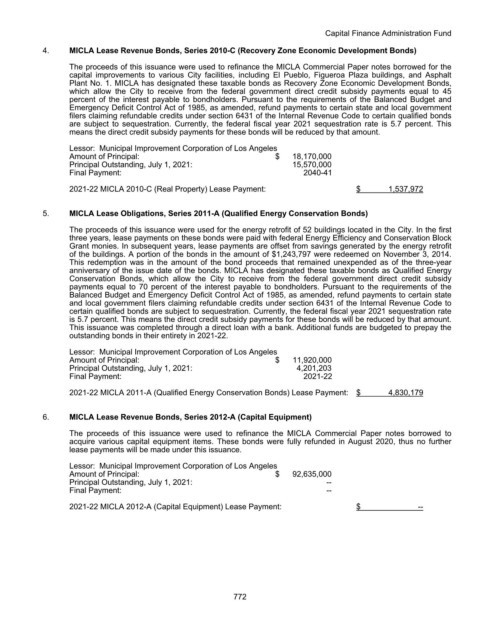

4. MICLA Lease Revenue Bonds, Series 2010-C (Recovery Zone Economic Development Bonds)

The proceeds of this issuance were used to refinance the MICLA Commercial Paper notes borrowed for the

capital improvements to various City facilities, including El Pueblo, Figueroa Plaza buildings, and Asphalt

Plant No. 1. MICLA has designated these taxable bonds as Recovery Zone Economic Development Bonds,

which allow the City to receive from the federal government direct credit subsidy payments equal to 45

percent of the interest payable to bondholders. Pursuant to the requirements of the Balanced Budget and

Emergency Deficit Control Act of 1985, as amended, refund payments to certain state and local government

filers claiming refundable credits under section 6431 of the Internal Revenue Code to certain qualified bonds

are subject to sequestration. Currently, the federal fiscal year 2021 sequestration rate is 5.7 percent. This

means the direct credit subsidy payments for these bonds will be reduced by that amount.

Lessor: Municipal Improvement Corporation of Los Angeles

Amount of Principal: $ 18,170,000

Principal Outstanding, July 1, 2021: 15,570,000

Final Payment: 2040-41

2021-22 MICLA 2010-C (Real Property) Lease Payment: $ 1,537,972

5. MICLA Lease Obligations, Series 2011-A (Qualified Energy Conservation Bonds)

The proceeds of this issuance were used for the energy retrofit of 52 buildings located in the City. In the first

three years, lease payments on these bonds were paid with federal Energy Efficiency and Conservation Block

Grant monies. In subsequent years, lease payments are offset from savings generated by the energy retrofit

of the buildings. A portion of the bonds in the amount of $1,243,797 were redeemed on November 3, 2014.

This redemption was in the amount of the bond proceeds that remained unexpended as of the three-year

anniversary of the issue date of the bonds. MICLA has designated these taxable bonds as Qualified Energy

Conservation Bonds, which allow the City to receive from the federal government direct credit subsidy

payments equal to 70 percent of the interest payable to bondholders. Pursuant to the requirements of the

Balanced Budget and Emergency Deficit Control Act of 1985, as amended, refund payments to certain state

and local government filers claiming refundable credits under section 6431 of the Internal Revenue Code to

certain qualified bonds are subject to sequestration. Currently, the federal fiscal year 2021 sequestration rate

is 5.7 percent. This means the direct credit subsidy payments for these bonds will be reduced by that amount.

This issuance was completed through a direct loan with a bank. Additional funds are budgeted to prepay the

outstanding bonds in their entirety in 2021-22.

Lessor: Municipal Improvement Corporation of Los Angeles

Amount of Principal: $ 11,920,000

Principal Outstanding, July 1, 2021: 4,201,203

Final Payment: 2021-22

2021-22 MICLA 2011-A (Qualified Energy Conservation Bonds) Lease Payment: $ 4,830,179

6. MICLA Lease Revenue Bonds, Series 2012-A (Capital Equipment)

The proceeds of this issuance were used to refinance the MICLA Commercial Paper notes borrowed to

acquire various capital equipment items. These bonds were fully refunded in August 2020, thus no further

lease payments will be made under this issuance.

Lessor: Municipal Improvement Corporation of Los Angeles

Amount of Principal: $ 92,635,000

Principal Outstanding, July 1, 2021: --

Final Payment: --

2021-22 MICLA 2012-A (Capital Equipment) Lease Payment: $ --

772