Page 513 - 2022-23 Blue Book Vol 2

P. 513

2022 TAX AND REVENUE ANTICIPATION NOTES

DEBT SERVICE FUND

BASIS FOR THE PROPOSED BUDGET

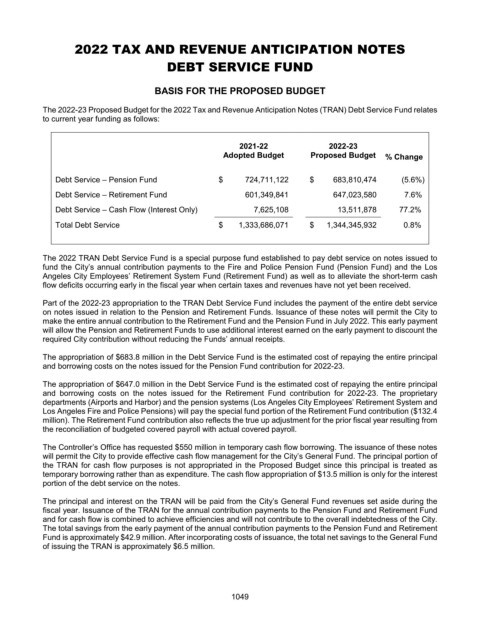

The 2022-23 Proposed Budget for the 2022 Tax and Revenue Anticipation Notes (TRAN) Debt Service Fund relates

to current year funding as follows:

2021-22 2022-23

Adopted Budget Proposed Budget % Change

Debt Service – Pension Fund $ 724,711,122 $ 683,810,474 (5.6%)

Debt Service – Retirement Fund 601,349,841 647,023,580 7.6%

Debt Service – Cash Flow (Interest Only) 7,625,108 13,511,878 77.2%

Total Debt Service $ 1,333,686,071 $ 1,344,345,932 0.8%

The 2022 TRAN Debt Service Fund is a special purpose fund established to pay debt service on notes issued to

fund the City’s annual contribution payments to the Fire and Police Pension Fund (Pension Fund) and the Los

Angeles City Employees’ Retirement System Fund (Retirement Fund) as well as to alleviate the short-term cash

flow deficits occurring early in the fiscal year when certain taxes and revenues have not yet been received.

Part of the 2022-23 appropriation to the TRAN Debt Service Fund includes the payment of the entire debt service

on notes issued in relation to the Pension and Retirement Funds. Issuance of these notes will permit the City to

make the entire annual contribution to the Retirement Fund and the Pension Fund in July 2022. This early payment

will allow the Pension and Retirement Funds to use additional interest earned on the early payment to discount the

required City contribution without reducing the Funds’ annual receipts.

The appropriation of $683.8 million in the Debt Service Fund is the estimated cost of repaying the entire principal

and borrowing costs on the notes issued for the Pension Fund contribution for 2022-23.

The appropriation of $647.0 million in the Debt Service Fund is the estimated cost of repaying the entire principal

and borrowing costs on the notes issued for the Retirement Fund contribution for 2022-23. The proprietary

departments (Airports and Harbor) and the pension systems (Los Angeles City Employees’ Retirement System and

Los Angeles Fire and Police Pensions) will pay the special fund portion of the Retirement Fund contribution ($132.4

million). The Retirement Fund contribution also reflects the true up adjustment for the prior fiscal year resulting from

the reconciliation of budgeted covered payroll with actual covered payroll.

The Controller’s Office has requested $550 million in temporary cash flow borrowing. The issuance of these notes

will permit the City to provide effective cash flow management for the City’s General Fund. The principal portion of

the TRAN for cash flow purposes is not appropriated in the Proposed Budget since this principal is treated as

temporary borrowing rather than as expenditure. The cash flow appropriation of $13.5 million is only for the interest

portion of the debt service on the notes.

The principal and interest on the TRAN will be paid from the City’s General Fund revenues set aside during the

fiscal year. Issuance of the TRAN for the annual contribution payments to the Pension Fund and Retirement Fund

and for cash flow is combined to achieve efficiencies and will not contribute to the overall indebtedness of the City.

The total savings from the early payment of the annual contribution payments to the Pension Fund and Retirement

Fund is approximately $42.9 million. After incorporating costs of issuance, the total net savings to the General Fund

of issuing the TRAN is approximately $6.5 million.

1049