Page 308 - FY 2022-23 Proposed Budget

P. 308

SPECIAL PURPOSE FUND SCHEDULES

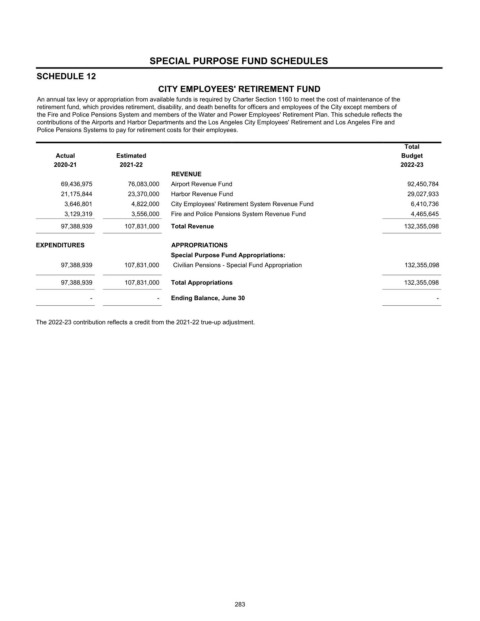

SCHEDULE 12

CITY EMPLOYEES' RETIREMENT FUND

An annual tax levy or appropriation from available funds is required by Charter Section 1160 to meet the cost of maintenance of the

retirement fund, which provides retirement, disability, and death benefits for officers and employees of the City except members of

the Fire and Police Pensions System and members of the Water and Power Employees' Retirement Plan. This schedule reflects the

contributions of the Airports and Harbor Departments and the Los Angeles City Employees' Retirement and Los Angeles Fire and

Police Pensions Systems to pay for retirement costs for their employees.

Total

Actual Estimated Budget

2020-21 2021-22 2022-23

REVENUE

69,436,975 76,083,000 11,726 Airport Revenue Fund 92,450,784

21,175,844 23,370,000 11,726.5 Harbor Revenue Fund 29,027,933

3,646,801 4,822,000 11,732 City Employees' Retirement System Revenue Fund 6,410,736

3,129,319 3,556,000 11,790 Fire and Police Pensions System Revenue Fund 4,465,645

97,388,939 107,831,000 Total Revenue 132,355,098

EXPENDITURES APPROPRIATIONS

Special Purpose Fund Appropriations:

97,388,939 107,831,000 1,095 Civilian Pensions - Special Fund Appropriation 132,355,098

97,388,939 107,831,000 Total Appropriations 132,355,098

- - Ending Balance, June 30 -

The 2022-23 contribution reflects a credit from the 2021-22 true-up adjustment.

283