Page 26 - FY 2020-21 Revenue Outlook

P. 26

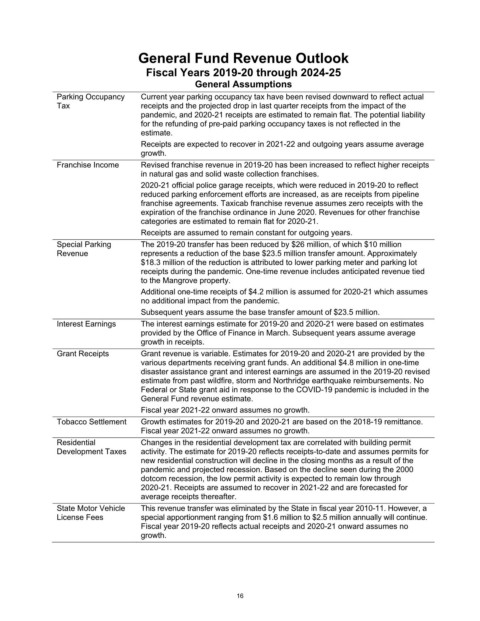

General Fund Revenue Outlook

Fiscal Years 2019-20 through 2024-25

General Assumptions

Parking Occupancy Current year parking occupancy tax have been revised downward to reflect actual

Tax receipts and the projected drop in last quarter receipts from the impact of the

pandemic, and 2020-21 receipts are estimated to remain flat. The potential liability

for the refunding of pre-paid parking occupancy taxes is not reflected in the

estimate.

Receipts are expected to recover in 2021-22 and outgoing years assume average

growth.

Franchise Income Revised franchise revenue in 2019-20 has been increased to reflect higher receipts

in natural gas and solid waste collection franchises.

2020-21 official police garage receipts, which were reduced in 2019-20 to reflect

reduced parking enforcement efforts are increased, as are receipts from pipeline

franchise agreements. Taxicab franchise revenue assumes zero receipts with the

expiration of the franchise ordinance in June 2020. Revenues for other franchise

categories are estimated to remain flat for 2020-21.

Receipts are assumed to remain constant for outgoing years.

Special Parking The 2019-20 transfer has been reduced by $26 million, of which $10 million

Revenue represents a reduction of the base $23.5 million transfer amount. Approximately

$18.3 million of the reduction is attributed to lower parking meter and parking lot

receipts during the pandemic. One-time revenue includes anticipated revenue tied

to the Mangrove property.

Additional one-time receipts of $4.2 million is assumed for 2020-21 which assumes

no additional impact from the pandemic.

Subsequent years assume the base transfer amount of $23.5 million.

Interest Earnings The interest earnings estimate for 2019-20 and 2020-21 were based on estimates

provided by the Office of Finance in March. Subsequent years assume average

growth in receipts.

Grant Receipts Grant revenue is variable. Estimates for 2019-20 and 2020-21 are provided by the

various departments receiving grant funds. An additional $4.8 million in one-time

disaster assistance grant and interest earnings are assumed in the 2019-20 revised

estimate from past wildfire, storm and Northridge earthquake reimbursements. No

Federal or State grant aid in response to the COVID-19 pandemic is included in the

General Fund revenue estimate.

Fiscal year 2021-22 onward assumes no growth.

Tobacco Settlement Growth estimates for 2019-20 and 2020-21 are based on the 2018-19 remittance.

Fiscal year 2021-22 onward assumes no growth.

Residential Changes in the residential development tax are correlated with building permit

Development Taxes activity. The estimate for 2019-20 reflects receipts-to-date and assumes permits for

new residential construction will decline in the closing months as a result of the

pandemic and projected recession. Based on the decline seen during the 2000

dotcom recession, the low permit activity is expected to remain low through

2020-21. Receipts are assumed to recover in 2021-22 and are forecasted for

average receipts thereafter.

State Motor Vehicle This revenue transfer was eliminated by the State in fiscal year 2010-11. However, a

License Fees special apportionment ranging from $1.6 million to $2.5 million annually will continue.

Fiscal year 2019-20 reflects actual receipts and 2020-21 onward assumes no

growth.

16