Page 21 - FY 2020-21 Revenue Outlook

P. 21

Receipts in Billion Dollars

6.0 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 of

3.4% 3.6%3.5% 25 24 23

5.9% 2.9%2.7%4.9% 22

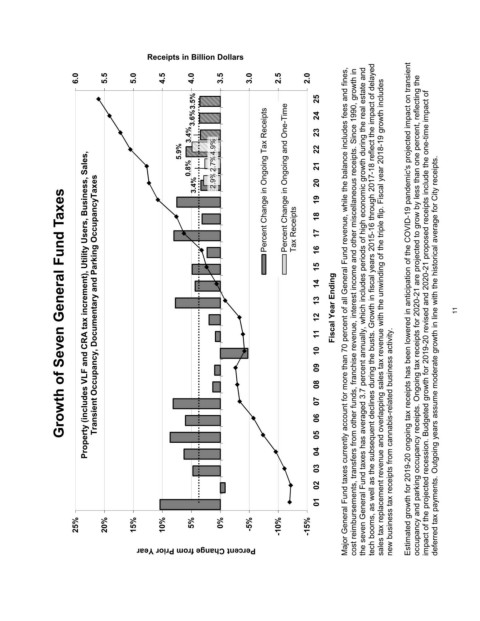

Property (includes VLF and CRA tax increment), Utility Users, Business, Sales,

3.4% 0.8% Percent Change in Ongoing Tax Receipts Percent Change in Ongoing and One-Time 21 20

Transient Occupancy, Documentary and Parking OccupancyTaxes

Growth of Seven General Fund Taxes

19

Tax Receipts 18 17

15 16

14

13 Fiscal Year Ending tech booms, as well as the subsequent declines during the busts. Growth in fiscal years 2015-16 through 2017-18 reflect the impact of delayed Estimated growth for 2019-20 ongoing tax receipts has been lowered in anticipation of the COVID-19 pandemic's projected impact on transient

12 Major General Fund taxes currently account for more than 70 percent of all General Fund revenue, while the balance includes fees and fines, cost reimbursements, transfers from other funds, franchise revenue, interest income and other miscellaneous receipts. Since 1990, growth in the seven General Fund taxes has averaged 3.7 percent annually, which includes periods of high economic growth durin

11 impact of the projected recession. Budgeted growth for 2019-20 revised and 2020-21 proposed receipts include the one-time impact

10 deferred tax payments. Outgoing years assume moderate growth in line with the historical average for City receipts.

09

08

07

06

05 new business tax receipts from cannabis-related business activity.

04

03

02

01

25% 20% 15% 10% 5% 0% -5% Percent Change from Prior Year -10% -15%