Page 34 - FY 2020-21 Revenue Outlook

P. 34

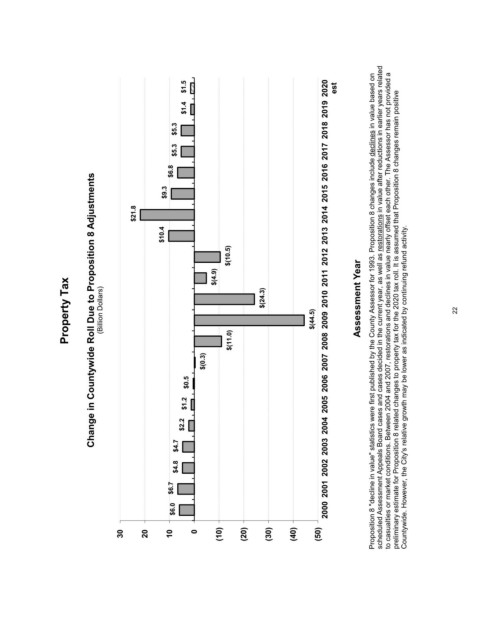

Property Tax

Change in Countywide Roll Due to Proposition 8 Adjustments

(Billion Dollars)

30

$21.8

20

$10.4 $9.3

10 $6.0 $6.7 $6.8 $5.3 $5.3

$4.7

$4.8

$2.2 $1.2 $0.5 $1.4 $1.5

0

$(0.3)

$(4.9)

(10)

$(11.0) $(10.5)

(20)

$(24.3)

(30)

(40)

$(44.5)

(50)

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

est

Assessment Year

Proposition 8 "decline in value" statistics were first published by the County Assessor for 1993. Proposition 8 changes include declines in value based on

scheduled Assessment Appeals Board cases and cases decided in the current year, as well as restorations in value after reductions in earlier years related

to casualties or market conditions. Between 2004 and 2007, restorations and declines in value nearly offset each other. The Assessor has not provided a

preliminary estimate for Proposition 8 related changes to property tax for the 2020 tax roll. It is assumed that Proposition 8 changes remain positive

Countywide. However, the City's relative growth may be lower as indicated by continuing refund activity.

22