Page 48 - FY 2022-23 Supporting Information

P. 48

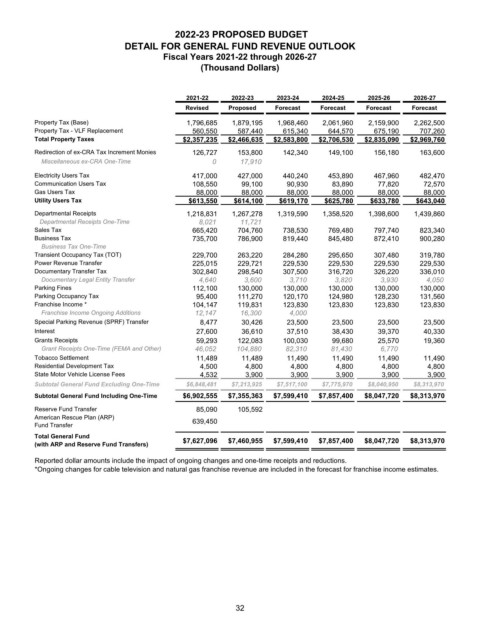

2022-23 PROPOSED BUDGET

DETAIL FOR GENERAL FUND REVENUE OUTLOOK

Fiscal Years 2021-22 through 2026-27

(Thousand Dollars)

2021-22 2022-23 2023-24 2024-25 2025-26 2026-27

Revised Proposed Forecast Forecast Forecast Forecast

Property Tax (Base) 1,796,685 1,879,195 1,968,460 2,061,960 2,159,900 2,262,500

Property Tax - VLF Replacement 560,550 587,440 615,340 644,570 675,190 707,260

Total Property Taxes $2,357,235 $2,466,635 $2,583,800 $2,706,530 $2,835,090 $2,969,760

Redirection of ex-CRA Tax Increment Monies 126,727 153,800 142,340 149,100 156,180 163,600

Miscellaneous ex-CRA One-Time 0 17,910

Electricity Users Tax 417,000 427,000 440,240 453,890 467,960 482,470

Communication Users Tax 108,550 99,100 90,930 83,890 77,820 72,570

Gas Users Tax 88,000 88,000 88,000 88,000 88,000 88,000

Utility Users Tax $613,550 $614,100 $619,170 $625,780 $633,780 $643,040

Departmental Receipts 1,218,831 1,267,278 1,319,590 1,358,520 1,398,600 1,439,860

Departmental Receipts One-Time 8,021 11,721

Sales Tax 665,420 704,760 738,530 769,480 797,740 823,340

Business Tax 735,700 786,900 819,440 845,480 872,410 900,280

Business Tax One-Time

Transient Occupancy Tax (TOT) 229,700 263,220 284,280 295,650 307,480 319,780

Power Revenue Transfer 225,015 229,721 229,530 229,530 229,530 229,530

Documentary Transfer Tax 302,840 298,540 307,500 316,720 326,220 336,010

Documentary Legal Entity Transfer 4,640 3,600 3,710 3,820 3,930 4,050

Parking Fines 112,100 130,000 130,000 130,000 130,000 130,000

Parking Occupancy Tax 95,400 111,270 120,170 124,980 128,230 131,560

Franchise Income * 104,147 119,831 123,830 123,830 123,830 123,830

Franchise Income Ongoing Additions 12,147 16,300 4,000

Special Parking Revenue (SPRF) Transfer 8,477 30,426 23,500 23,500 23,500 23,500

Interest 27,600 36,610 37,510 38,430 39,370 40,330

Grants Receipts 59,293 122,083 100,030 99,680 25,570 19,360

Grant Receipts One-Time (FEMA and Other) 46,052 104,880 82,310 81,430 6,770

Tobacco Settlement 11,489 11,489 11,490 11,490 11,490 11,490

Residential Development Tax 4,500 4,800 4,800 4,800 4,800 4,800

State Motor Vehicle License Fees 4,532 3,900 3,900 3,900 3,900 3,900

Subtotal General Fund Excluding One-Time $6,848,481 $7,213,925 $7,517,100 $7,775,970 $8,040,950 $8,313,970

Subtotal General Fund Including One-Time $6,902,555 $7,355,363 $7,599,410 $7,857,400 $8,047,720 $8,313,970

Reserve Fund Transfer 85,090 105,592

American Rescue Plan (ARP) 639,450

Fund Transfer

Total General Fund $7,627,096 $7,460,955 $7,599,410 $7,857,400 $8,047,720 $8,313,970

(with ARP and Reserve Fund Transfers)

Reported dollar amounts include the impact of ongoing changes and one-time receipts and reductions.

*Ongoing changes for cable television and natural gas franchise revenue are included in the forecast for franchise income estimates.

32