Page 476 - 2020-21 Budget Summary

P. 476

Revenue Forecast Report

Discussion

Debt and Debt Service Requirements

City Debt Policy

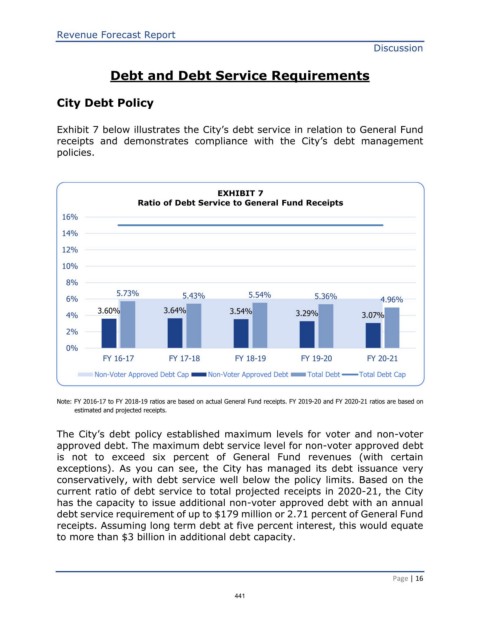

Exhibit 7 below illustrates the City’s debt service in relation to General Fund

receipts and demonstrates compliance with the City’s debt management

policies.

EXHIBIT 7

Ratio of Debt Service to General Fund Receipts

16%

14%

12%

10%

8%

5.73% 5.54%

6% 5.43% 5.36% 4.96%

3.60% 3.64% 3.54%

4% 3.29% 3.07%

2%

0%

FY 16-17 FY 17-18 FY 18-19 FY 19-20 FY 20-21

Non-Voter Approved Debt Cap Non-Voter Approved Debt Total Debt Total Debt Cap

Note: FY 2016-17 to FY 2018-19 ratios are based on actual General Fund receipts. FY 2019-20 and FY 2020-21 ratios are based on

estimated and projected receipts.

The City’s debt policy established maximum levels for voter and non-voter

approved debt. The maximum debt service level for non-voter approved debt

is not to exceed six percent of General Fund revenues (with certain

exceptions). As you can see, the City has managed its debt issuance very

conservatively, with debt service well below the policy limits. Based on the

current ratio of debt service to total projected receipts in 2020-21, the City

has the capacity to issue additional non-voter approved debt with an annual

debt service requirement of up to $179 million or 2.71 percent of General Fund

receipts. Assuming long term debt at five percent interest, this would equate

to more than $3 billion in additional debt capacity.

Page | 16

441