Page 474 - 2020-21 Budget Summary

P. 474

Revenue Forecast Report

Discussion

General Fund Cash Flow Borrowing

Current and Prior Year Experience

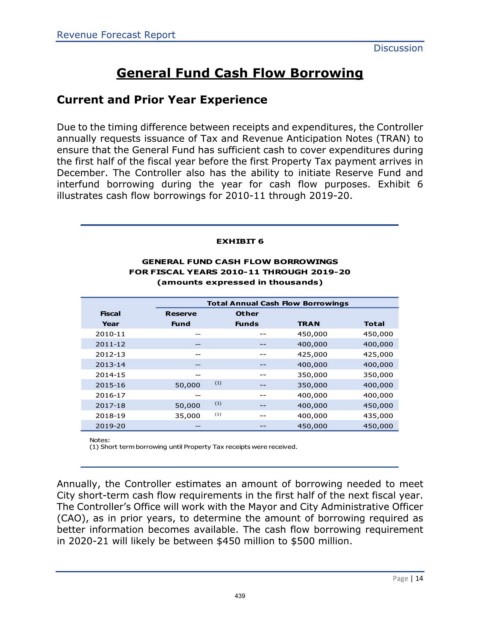

Due to the timing difference between receipts and expenditures, the Controller

annually requests issuance of Tax and Revenue Anticipation Notes (TRAN) to

ensure that the General Fund has sufficient cash to cover expenditures during

the first half of the fiscal year before the first Property Tax payment arrives in

December. The Controller also has the ability to initiate Reserve Fund and

interfund borrowing during the year for cash flow purposes. Exhibit 6

illustrates cash flow borrowings for 2010-11 through 2019-20.

EXHIBIT 6

GENERAL FUND CASH FLOW BORROWINGS

FOR FISCAL YEARS 2010-11 THROUGH 2019-20

(amounts expressed in thousands)

Total Annual Cash Flow Borrowings

Fiscal Reserve Other

Year Fund Funds TRAN Total

2010-11 -- -- 450,000 450,000

2011-12 -- -- 400,000 400,000

2012-13 -- -- 425,000 425,000

2013-14 -- -- 400,000 400,000

--

2014-15 -- (1) -- 350,000 350,000

2015-16

50,000

400,000

350,000

2016-17 -- -- 400,000 400,000

2017-18 50,000 (1) -- 400,000 450,000

2018-19 35,000 (1) -- 400,000 435,000

2019-20 -- -- 450,000 450,000

Notes:

(1) Short term borrowing until Property Tax receipts were received.

Annually, the Controller estimates an amount of borrowing needed to meet

City short-term cash flow requirements in the first half of the next fiscal year.

The Controller’s Office will work with the Mayor and City Administrative Officer

(CAO), as in prior years, to determine the amount of borrowing required as

better information becomes available. The cash flow borrowing requirement

in 2020-21 will likely be between $450 million to $500 million.

Page | 14

439