Page 40 - 2020-21 Supporting Information Book_Revised

P. 40

2020-21 PROPOSED BUDGET

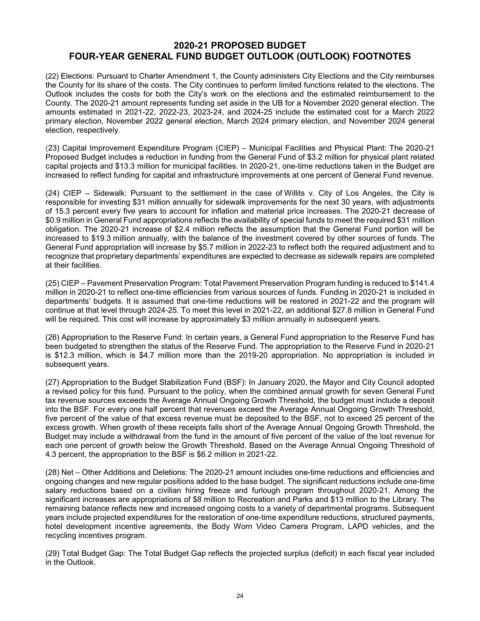

(22) Elections: Pursuant to Charter Amendment 1, the County administers City Elections and the City reimburses

the County for its share of the costs. The City continues to perform limited functions related to the elections. The

FOUR-YEAR GENERAL FUND BUDGET OUTLOOK (OUTLOOK) FOOTNOTES

Outlook includes the costs for both the City’s work on the elections and the estimated reimbursement to the

County. The 2020-21 amount represents funding set aside in the UB for a November 2020 general election. The

REVENUE:

(22) Elections: Pursuant to Charter Amendment 1, the County administers City Elections and the City reimburses

amounts estimated in 2021-22, 2022-23, 2023-24, and 2024-25 include the estimated cost for a March 2022

the County for its share of the costs. The City continues to perform limited functions related to the elections. The

primary election, November 2022 general election, March 2024 primary election, and November 2024 general

(1) General Fund (GF) Base: The revenue base for each year represents the prior year’s estimated revenues.

Outlook includes the costs for both the City’s work on the elections and the estimated reimbursement to the

election, respectively.

County. The 2020-21 amount represents funding set aside in the UB for a November 2020 general election. The

(2) Revenue Growth: Revenue projections reflect the consensus of economists that the first quarter in 2020 will

amounts estimated in 2021-22, 2022-23, 2023-24, and 2024-25 include the estimated cost for a March 2022

(23) Capital Improvement Expenditure Program (CIEP) – Municipal Facilities and Physical Plant: The 2020-21

mark the start of a recession, however, there is no consensus on its severity or length. Citing the relative good

primary election, November 2022 general election, March 2024 primary election, and November 2024 general

Proposed Budget includes a reduction in funding from the General Fund of $3.2 million for physical plant related

health of the pre-pandemic economy, higher state and local government reserves, and current stimulus efforts,

election, respectively.

capital projects and $13.3 million for municipal facilities. In 2020-21, one-time reductions taken in the Budget are

the Outlook assumes recovery in 2021. The current Safer at Home order is projected to end in May and the

increased to reflect funding for capital and infrastructure improvements at one percent of General Fund revenue.

estimated receipts for 2020-21 and revenue growth for outgoing years reflect this assumption. The assumptions

(23) Capital Improvement Expenditure Program (CIEP) – Municipal Facilities and Physical Plant: The 2020-21

for economy sensitive revenues are also based on a single nonessential business closure event and no future

Proposed Budget includes a reduction in funding from the General Fund of $3.2 million for physical plant related

(24) CIEP – Sidewalk: Pursuant to the settlement in the case of Willits v. City of Los Angeles, the City is

Safer at Home orders. The amounts represent projected incremental change to the base. Any one-time receipts

capital projects and $13.3 million for municipal facilities. In 2020-21, one-time reductions taken in the Budget are

responsible for investing $31 million annually for sidewalk improvements for the next 30 years, with adjustments

are deducted from the estimated revenue growth for the following fiscal year.

increased to reflect funding for capital and infrastructure improvements at one percent of General Fund revenue.

of 15.3 percent every five years to account for inflation and material price increases. The 2020-21 decrease of

$0.9 million in General Fund appropriations reflects the availability of special funds to meet the required $31 million

The total projected revenue reflects above average growth in 2020-21 attributed to one-time receipts of delayed

(24) CIEP – Sidewalk: Pursuant to the settlement in the case of Willits v. City of Los Angeles, the City is

obligation. The 2020-21 increase of $2.4 million reflects the assumption that the General Fund portion will be

2019-20 payments and deferred tax collection efforts as well as a third quarter economic rebound. Outgoing years

responsible for investing $31 million annually for sidewalk improvements for the next 30 years, with adjustments

increased to $19.3 million annually, with the balance of the investment covered by other sources of funds. The

include average growth.

of 15.3 percent every five years to account for inflation and material price increases. The 2020-21 decrease of

General Fund appropriation will increase by $5.7 million in 2022-23 to reflect both the required adjustment and to

$0.9 million in General Fund appropriations reflects the availability of special funds to meet the required $31 million

recognize that proprietary departments’ expenditures are expected to decrease as sidewalk repairs are completed

obligation. The 2020-21 increase of $2.4 million reflects the assumption that the General Fund portion will be

(3) Property tax growth is projected at 6.6 percent for 2020-21 with historic growth for ensuing fiscal years.

at their facilities.

Documentary Transfer is a volatile revenue in particular when sales volume and price move together. The current

increased to $19.3 million annually, with the balance of the investment covered by other sources of funds. The

year estimate assumes that pricing and sales volume hold steady, as the predicted recession is not being driven

General Fund appropriation will increase by $5.7 million in 2022-23 to reflect both the required adjustment and to

(25) CIEP – Pavement Preservation Program: Total Pavement Preservation Program funding is reduced to $141.4

by the housing market. Should pandemic-related layoffs result in permanent job loss, there is downside risk to this

recognize that proprietary departments’ expenditures are expected to decrease as sidewalk repairs are completed

million in 2020-21 to reflect one-time efficiencies from various sources of funds. Funding in 2020-21 is included in

at their facilities.as well. The Outlook includes steady growth in outgoing years as home prices are restrained by

revenue source

departments’ budgets. It is assumed that one-time reductions will be restored in 2021-22 and the program will

affordability. The Residential Development Tax is another volatile revenue which is being impacted by COVID-19

continue at that level through 2024-25. To meet this level in 2021-22, an additional $27.8 million in General Fund

and the slowing of construction activity for new dwelling units. A significant rebound is expected in 2021-22 with

(25) CIEP – Pavement Preservation Program: Total Pavement Preservation Program funding is reduced to $141.4

will be required. This cost will increase by approximately $3 million annually in subsequent years.

a return to gradual growth thereafter.

million in 2020-21 to reflect one-time efficiencies from various sources of funds. Funding in 2020-21 is included in

departments’ budgets. It is assumed that one-time reductions will be restored in 2021-22 and the program will

(26) Appropriation to the Reserve Fund: In certain years, a General Fund appropriation to the Reserve Fund has

(4) Business tax revenue assumes the recovery of delayed 2019-20 receipts totaling $44.7 million in 2020-21.

continue at that level through 2024-25. To meet this level in 2021-22, an additional $27.8 million in General Fund

been budgeted to strengthen the status of the Reserve Fund. The appropriation to the Reserve Fund in 2020-21

Based on declines for previous recessions a 7 percent decrease is assumed for non-cannabis r

will be required. This cost will increase by approximately $3 million annually in subsequent years.enewal activity.

is $12.3 million, which is $4.7 million more than the 2019-20 appropriation. No appropriation is included in

Cannabis-related business activity assumes that current-year growth continues at 25 percent with no impact from

subsequent years.

the pandemic or recession. Total business tax growth for 2021-22 assumes recovery in non-cannabis business

(26) Appropriation to the Reserve Fund: In certain years, a General Fund appropriation to the Reserve Fund has

activity.

been budgeted to strengthen the status of the Reserve Fund. The appropriation to the Reserve Fund in 2020-21

(27) Appropriation to the Budget Stabilization Fund (BSF): In January 2020, the Mayor and City Council adopted

is $12.3 million, which is $4.7 million more than the 2019-20 appropriation. No appropriation is included in

a revised policy for this fund. Pursuant to the policy, when the combined annual growth for seven General Fund

Sales tax growth is based on available economic forecasts and assumes a 5 percent decline for 2020-21 followed

subsequent years.

tax revenue sources exceeds the Average Annual Ongoing Growth Threshold, the budget must include a deposit

by 3.8 percent average growth in the outgoing years. Subsequent to the formulation of this estimate, the State

into the BSF. For every one half percent that revenues exceed the Average Annual Ongoing Growth Threshold,

extended the due date for the payment of quarterly sales tax owed by businesses. The reduction to City receipts

(27) Appropriation to the Budget Stabilization Fund (BSF): In January 2020, the Mayor and City Council adopted

five percent of the value of that excess revenue must be deposited to the BSF, not to exceed 25 percent of the

will be first realized before the close of 2019-20 and the impact from extended payment periods would continue

a revised policy for this fund. Pursuant to the policy, when the combined annual growth for seven General Fund

excess growth. When growth of these receipts falls short of the Average Annual Ongoing Growth Threshold, the

until 2021-22.

tax revenue sources exceeds the Average Annual Ongoing Growth Threshold, the budget must include a deposit

Budget may include a withdrawal from the fund in the amount of five percent of the value of the lost revenue for

into the BSF. For every one half percent that revenues exceed the Average Annual Ongoing Growth Threshold,

each one percent of growth below the Growth Threshold. Based on the Average Annual Ongoing Threshold of

(5) Electricity Users tax reflects an economic driven decline in 2020-21 consistent with estimates provided by the

five percent of the value of that excess revenue must be deposited to the BSF, not to exceed 25 percent of the

4.3 percent, the appropriation to the BSF is $6.2 million in 2021-22.

Department of Water and Power, reflecting current assumptions on rates and electricity consumption and adjusted

excess growth. When growth of these receipts falls short of the Average Annual Ongoing Growth Threshold, the

to reflect uncollectable receipts which are expected to significantly increase as a result of the financial hardships

Budget may include a withdrawal from the fund in the amount of five percent of the value of the lost revenue for

(28) Net – Other Additions and Deletions: The 2020-21 amount includes one-time reductions and efficiencies and

brought on by COVID-19. After a recovery in 2021-22, the outgoing years of revenue are consistent with historical

each one percent of growth below the Growth Threshold. Based on the Average Annual Ongoing Threshold of

ongoing changes and new regular positions added to the base budget. The significant reductions include one-time

growth.

4.3 percent, the appropriation to the BSF is $6.2 million in 2021-22.

salary reductions based on a civilian hiring freeze and furlough program throughout 2020-21. Among the

significant increases are appropriations of $8 million to Recreation and Parks and $13 million to the Library. The

The 2020-21 reduction in Gas Users tax revenue and no growth outlook is based on the full implementation of a

(28) Net – Other Additions and Deletions: The 2020-21 amount includes one-time reductions and efficiencies and

remaining balance reflects new and increased ongoing costs to a variety of departmental programs. Subsequent

taxpayer settlement agreement that reduces the tax base.

ongoing changes and new regular positions added to the base budget. The significant reductions include one-time

years include projected expenditures for the restoration of one-time expenditure reductions, structured payments,

salary reductions based on a civilian hiring freeze and furlough program throughout 2020-21. Among the

hotel development incentive agreements, the Body Worn Video Camera Program, LAPD vehicles, and the

The decline in Communications Users tax revenue continues due to aggressive wireless plan pricing and the

significant increases are appropriations of $8 million to Recreation and Parks and $13 million to the Library. The

recycling incentives program.

decrease in landline use. Average declines of 7.9 percent are anticipated as part of the Outlook.

remaining balance reflects new and increased ongoing costs to a variety of departmental programs. Subsequent

years include projected expenditures for the restoration of one-time expenditure reductions, structured payments,

(29) Total Budget Gap: The Total Budget Gap reflects the projected surplus (deficit) in each fiscal year included

hotel development incentive agreements, the Body Worn Video Camera Program, LAPD vehicles, and the

in the Outlook.

recycling incentives program.

(29) Total Budget Gap: The Total Budget Gap reflects the projected surplus (deficit) in each fiscal year included

in the Outlook.

21

24

24