Page 62 - FY 2022-23 Revenue Outlook

P. 62

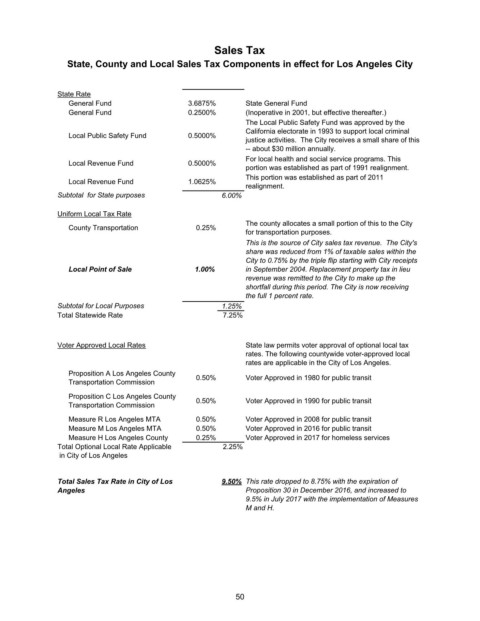

Sales Tax

State, County and Local Sales Tax Components in effect for Los Angeles City

State Rate

General Fund 3.6875% State General Fund

General Fund 0.2500% (Inoperative in 2001, but effective thereafter.)

The Local Public Safety Fund was approved by the

California electorate in 1993 to support local criminal

Local Public Safety Fund 0.5000%

justice activities. The City receives a small share of this

-- about $30 million annually.

For local health and social service programs. This

Local Revenue Fund 0.5000%

portion was established as part of 1991 realignment.

This portion was established as part of 2011

Local Revenue Fund 1.0625%

realignment.

Subtotal for State purposes 6.00%

Uniform Local Tax Rate

The county allocates a small portion of this to the City

County Transportation 0.25%

for transportation purposes.

This is the source of City sales tax revenue. The City's

share was reduced from 1% of taxable sales within the

City to 0.75% by the triple flip starting with City receipts

Local Point of Sale 1.00% in September 2004. Replacement property tax in lieu

revenue was remitted to the City to make up the

shortfall during this period. The City is now receiving

the full 1 percent rate.

Subtotal for Local Purposes 1.25%

Total Statewide Rate 7.25%

Voter Approved Local Rates State law permits voter approval of optional local tax

rates. The following countywide voter-approved local

rates are applicable in the City of Los Angeles.

Proposition A Los Angeles County

Transportation Commission 0.50% Voter Approved in 1980 for public transit

Proposition C Los Angeles County 0.50% Voter Approved in 1990 for public transit

Transportation Commission

Measure R Los Angeles MTA 0.50% Voter Approved in 2008 for public transit

Measure M Los Angeles MTA 0.50% Voter Approved in 2016 for public transit

Measure H Los Angeles County 0.25% Voter Approved in 2017 for homeless services

Total Optional Local Rate Applicable 2.25%

in City of Los Angeles

Total Sales Tax Rate in City of Los 9.50% This rate dropped to 8.75% with the expiration of

Angeles Proposition 30 in December 2016, and increased to

9.5% in July 2017 with the implementation of Measures

M and H.

50